In 2020, Minnesota Realtors® partnered with the Minnesota Homeownership Center to launch the Minnesota Downpayment Assistance Research Project. Our goals were to identify ways we can remove barriers facing homebuyers with limited savings and make progress on reducing the racial homeownership gap. Ultimately this research is intended to help us explore opportunities for improving policies and programs for downpayment assistance (DPA).

In 2020, Minnesota Realtors® partnered with the Minnesota Homeownership Center to launch the Minnesota Downpayment Assistance Research Project. Our goals were to identify ways we can remove barriers facing homebuyers with limited savings and make progress on reducing the racial homeownership gap. Ultimately this research is intended to help us explore opportunities for improving policies and programs for downpayment assistance (DPA).

Quantifying the need for downpayment assistance

Summary from the Rosen Consulting Group research report

Low and moderate income (LMI) households and communities of color face many roadblocks on the path to homeownership. Lack of money for a downpayment is one of the most significant barriers. Many new homebuyers overcome this obstacle with financial assistance from family and friends. However, most LMI households and first-generation homebuyers do not have access to these sources of capital. DPA provides a range of financial products — from forgivable grants to loans — for buyers with sufficient income to pay a mortgage but not enough money for a downpayment.

Increasing homeownership among Minnesota households is an important policy objective that can benefit the entire state. Owning a home promotes financial stability, strengthens communities’ social fabric, and delivers innumerable psychological benefits. But for LMI and non-White households, the dream of homeownership is often hindered by language barriers, financial illiteracy, lack of capital, limited economic opportunities, and systemic racism. Even worse, these buyers struggle with a shortage of affordable housing, impeded access to adequate credit, and, of course, not enough money for a downpayment.

Roadblock 1: Limited Supply of Affordable Housing

A limited supply of affordable housing poses a significant obstacle to homeownership.

Roadblock 2: Access to Adequate Credit

Those with no or little credit history encounter difficulty in securing a mortgage.

Roadblock 3: Lack of Sufficient Down Payment Capital

The lack of capital for a downpayment is arguably the most significant financial barrier to homeownership.

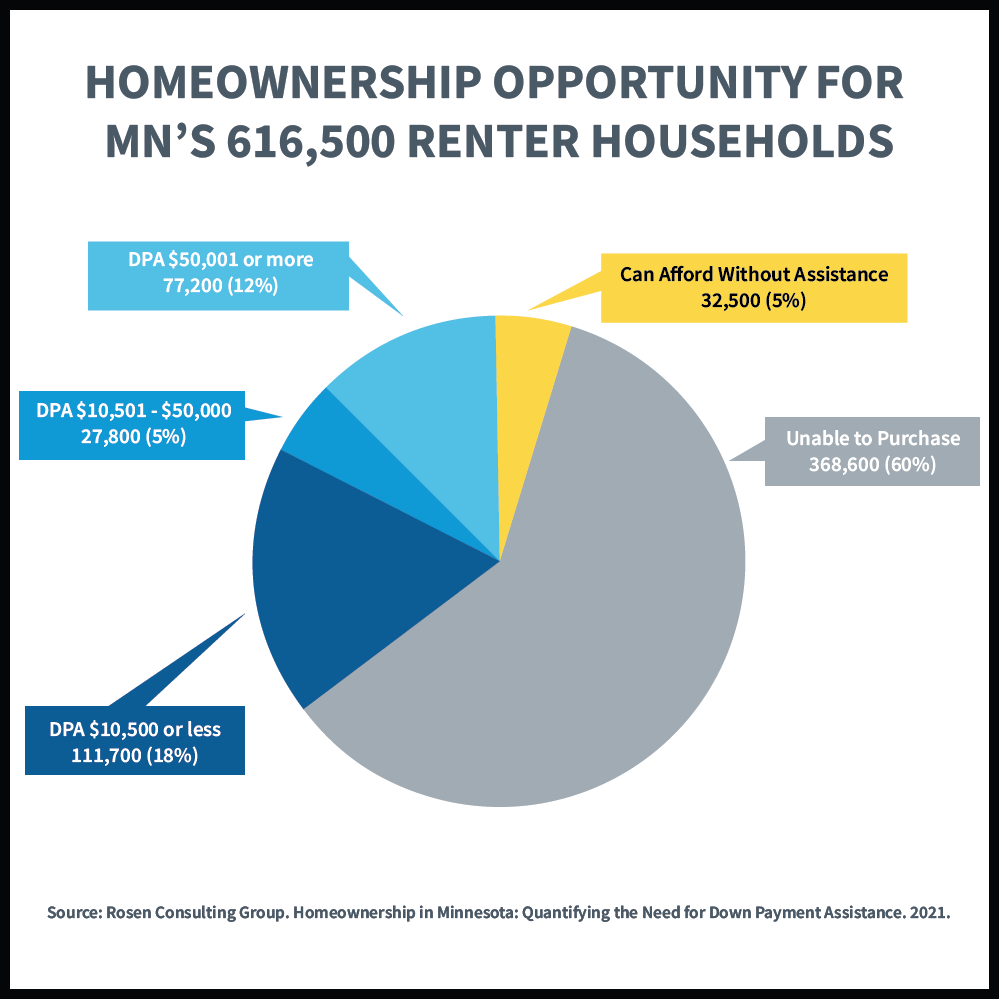

Homeownership opportunity for MN’s 616,500 renter households

Minnesota homeownership trends

The statewide homeownership rate among households in Minnesota was 71.9% as of 2019, above the 64.1% reported for the U.S.

The homeownership rate among non-White households in Minnesota in 2019 was 43.5%, well below that for White households at 76.9%. The homeownership rate for Black households in Minnesota was 25.3% as of 2019 vs. 42.0% nationwide.

73% of Minnesotan homeowners were concentrated in the below five regions of the state with the following homeownership rates (2018):

- Rochester: 75.5%

- Duluth: 72.6%

- Twin Cities: 69.7%

- Cloud: 68.5%

- Mankato: 65.7%

Opportunity for creating homeowners with DPA

There are 616,500 renter households in the state of Minnesota. Research estimates that with DPA of $10,500 or less, 111,700 renters could purchase a median-priced home in their area. The work is just getting started, and we are committed to closing the homeownership gap by exploring and supporting policies and programs that can help.

To learn more and access the full report, please visit mnrealtor.com/dparesearch.