The median home price rose 2.9% statewide to $355,000 and increased 2.6% to $390,000 in the Twin Cities metro last year. Both are record highs and mark the 14th consecutive year of price gains. This was driven by an ongoing imbalance between supply and demand; higher-end luxury activity combined with less entry-level activity, wage growth, and a slight decrease in rates. But the share of statewide sales over $1M has tripled from 2020 to over 3.5%. Luxury buyers aren’t rate-sensitive like most other buyers and have wealth tied to a rising stock market, so the luxury segment continued to outperform despite the higher rate environment. Second time or move-up buyers had the luxury of rolling over the equity from their last property.

Market times increased 4.8% to 44 days statewide. That’s the longest market time since 2020 when homes spent 47 days on market. Some price ranges sold more quickly while others took longer. Condos in particular spent longer on the market. Homes sold in record time during the buying frenzy of 2020 and 2021 but sellers have had to be more patient over last few years. “Educated sellers knew they’d likely have to be more patient and flexible but most also understood that they’re still in a relatively strong position with limited alternatives for buyers,” said Danielle Pelton, President of the St. Paul Area Association of Realtors®. “But that of course varied widely by price point, segment and location. That’s why it’s crucial to work with a professional who knows the ins, outs and complexities of the local market.”

There Were Key Difference Between Market Segments. For Example, in the Twin Cities:

There Were Also Notable Differences Across Different Regions of the State

“Housing is local. So, while headlines say one thing, the real story depends on the community and the kind of home you’re talking about,” said Aarica Coleman, President of Minneapolis Area Realtors®. “Some buyers are still facing competition, while others are seeing more time, more options, and more negotiating room.”

Wrap-Up and Outlook

Short term factors matter, but in the long run the economy and labor market determine the health and sustainability of the housing market. Strong job and population growth tend to lead to more robust housing markets. A growing number of reliable, well-paying jobs is essential to making monthly payments, keeping up with maintenance and sustaining demand for residential property. And an expanding housing supply allows for not just more homeownership, but it supports community growth and facilitates economic development. In Minnesota, our incomes, homeownership rate, educational attainment, Fortune 500 companies, life expectancy, voter turnout and even bicycle ridership are above average while our home prices and unemployment rate are below average. But housing affects the economy, and the economy affects housing. When housing is stuck and undersupplied, the impact ripples beyond housing affordability and into job and business growth, economic development, workforce mobility, inequality and beyond. We have our share of challenges around affordability, construction and regulation, taxes and insurance and more. But despite these challenges, Minnesota is well positioned for continued success moving forward.

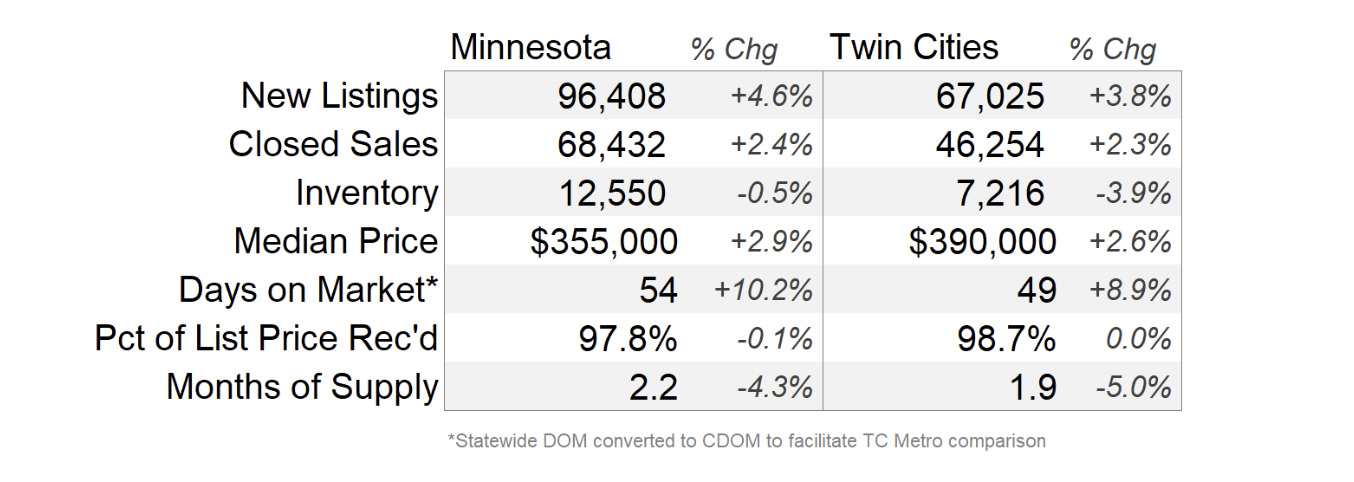

2025 By the Numbers | Compared to 2024

2025 Mapped | Exploring Spatial Market Trends